Sales & Use Tax 101 Series: Taxability

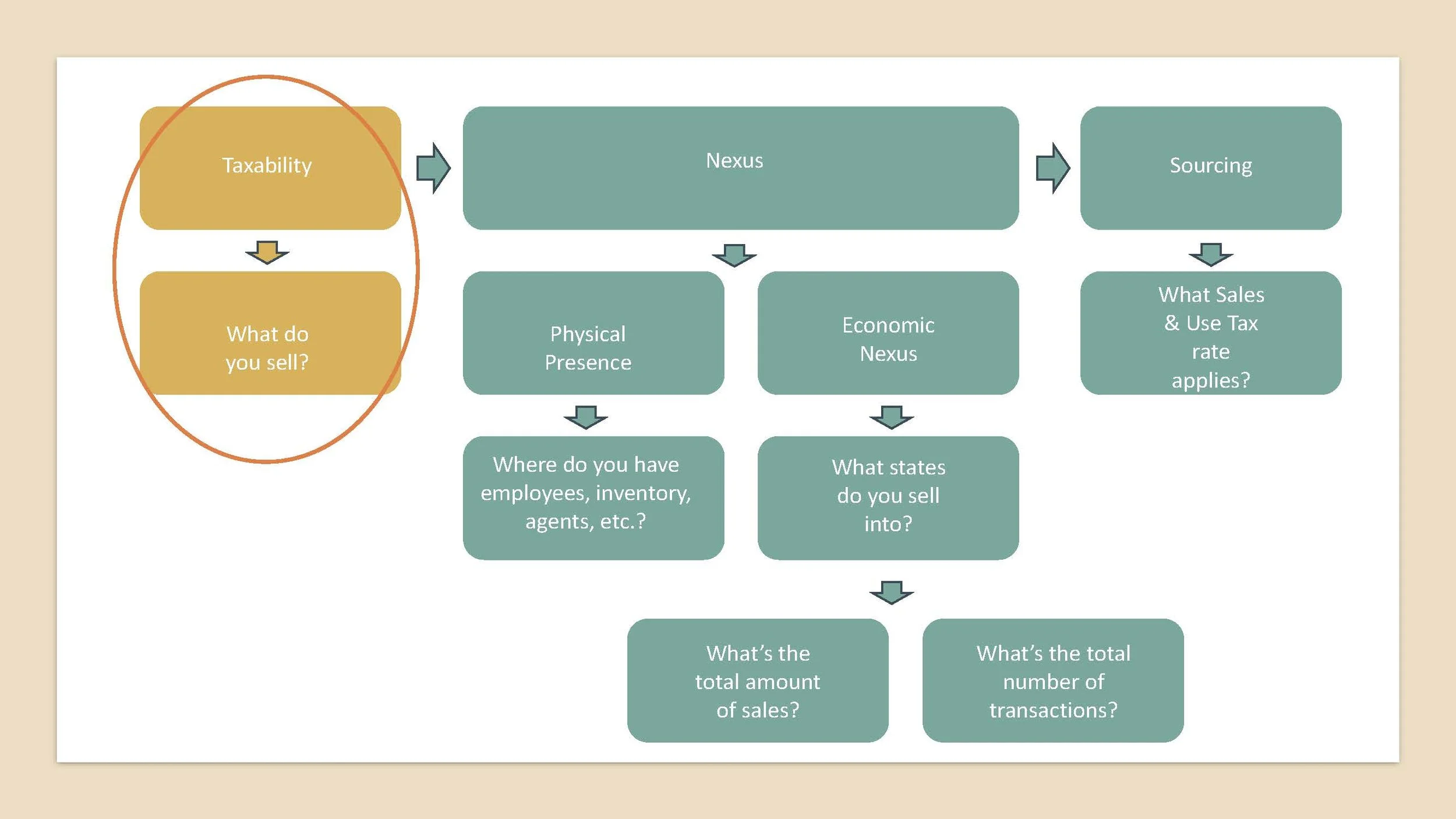

In this blog we’re doing a deep dive into the question of “taxability” in the world of sales tax.

In determining whether sales tax applies, and at what rates, the place to start is to ask yourself whether what you as a business are selling is actually taxable. So, what do you sell?

This may sound like a straightforward or obvious question, but we’re going to highlight what this question is actually asking from the legal, tax perspective.

What Do You Sell?

So, what do you sell? You may say, I sell purses, I sell software, I sell coaching, etc. Let’s back up just a little bit though. In the sales tax world, when we think of sales tax, we are going to ask, is what you sell a good? A service? Or something combining them? Or something mixing them?

Goods:

Generally, in sales tax world, goods are taxable which means they have sales tax imposed on them that the consumer pays and you the business collect and remit to the appropriate authorities.

There are some exceptions to this, though. You may have consumers that live in a state that doesn’t have sales tax. Or you may sell a specific type of good that is exempt even if the state does have sales tax. It is important to consult with a tax attorney to know if what you are selling is subject to sales tax or exempt.

And just remember, even though you may “know” that a state doesn’t have sales tax, some of those states still have other similar taxes, like a tax on the privilege of doing business in their state or a gross revenue tax, etc. that encompasses some of the aspects of sales tax.

Services:

Generally, services are not taxable (not subject to sales tax). Again, however, this is not necessarily always true. For a long time, a lot of services were excluded from sales tax. However, a number of states, to increase their tax base, have been including more and more services in the list of transactions subject to sales tax.

So, please talk with a tax attorney to determine if the services you are providing, in the states you are providing them, are or are not subject to sales tax.

Bundled & Mixed Transactions:

Now, some sales transactions don’t fit neatly into a goods box or a services box. For example, you may be a massage therapist and you decide to start selling spa products to clients. Or maybe you are a software company that has software or an app people pay to access that you are also providing services through. These are two separate types of categories that we’ll look at.

Bundled Transactions:

First, let’s look at our example of the massage therapist selling spa products to clients. This is a “bundled” transaction. You are bundling services and goods together in your business. Now, as we mentioned above, generally sales tax applies to goods and not to services (with the caveat above). If the services you are providing are not subject to sales tax but the goods you are providing are, you want to make sure that you don’t accidentally or unknowingly charge the wrong sales tax.

With a bundled transaction, if the sales transaction is charged on the same receipt and not separate (for example, the services and goods are on the same receipt and it is not clear what was charged for each separately or even if it’s not clear that they are not together), then sales tax will be charged on the entire transaction (both for the services and goods) rather than just the goods (or whatever is subject to sales tax in the situation).

You want to make sure as a business that if you are bundling transactions that you keep them separate for reporting and tax purposes. You can do this by reporting them as separate line items on an invoice or receipt. Then, you would charge sales tax only on the line items subject to tax.

Mixed Transactions:

Okay, let’s look at our software example now. Let’s say you as a business have an online banking service with a platform. People pay to be using the software and for the banking services. If it is too difficult to separate out what is a service and what is a good (for example, if may not be clear how you are charging for using the platform for banking vs. using the banking services with actual bankers), then you have a mixed transaction. In other words, a mixed transaction is a transaction that has both taxable and nontaxable elements that cannot be separately identified.

With a mixed transaction, the question of taxability (and whether the transaction for the sale you are making is subject to sales tax or not) depends on the true “essence of the transaction”. This term, “essence of the transaction,” is a very specific legal term in the sales tax world. Really, you are trying to understand what the purchaser’s motive is in engaging in the transaction. I know. Super subjective. Luckily, we have some case law, and this also means that what courts are looking at is heavily facts and circumstances based.

So, in defining what you sell, if you have a mixed transaction, you will want to think through (and definitely seek out help from a tax attorney!) what the purchaser intended to buy. Was it goods/products or a service? (You will then have to look to see if those goods or services are subject to sales tax or not.)

If you have any questions or if you need help in defining what you sell, please come talk to us! We’ll be talking about nexus for sales tax purposes in our next blog.